how does the arizona charitable tax credit work

Thanks to the Arizona Charitable Tax Credit you can donate up to 800 and get it right back on your Arizona tax return. They are called dollar- for-dollar credits because each one takes a Tax Credits dollar off your Arizona income tax for each dollar you give up to the credits limits.

Will You Partner With Us To Help Those In Need

The efforts of this coalition of charities.

. Be an Arizona resident. Marys Food Bank will provide food to hungry children in Arizona. Marys Food Bank and get all of it back in your Arizona Tax Refund.

Arizona provides two separate tax credits for individuals who make contributions to charitable organizations. The Arizona Charitable Tax Credit permits any credits for contributions to Qualified Charitable Organizations QCOs and Qualifying Foster Care Charitable Organizations QFCOs that are not applied against tax obligations for the most recent taxable year to be carried forward for a period of five consecutive years. 2 Ways 2 Give.

The regulations provide exceptions for dollar-for-dollar state tax deductions and for tax credits of no more than 15 percent of the amount transferred. The Arizona Charitable Tax Credit was created to help taxpayers support charities that offer services to low-income residents with chronic illnesses or disabilities. A taxpayer who itemizes deductions must reduce the 1000 federal charitable contribution deduction by the 700 state tax credit leaving a federal charitable contribution deduction of 300.

To Claim the Credit You Must. Qualifying Charitable Organization Tax Credit single filers maximum gift 400 and married filers up to 800. Arizona offers dollar-for-dollar income tax credits for individuals.

With the Arizona Charitable Tax Credit you can donate up to 800 to St. How the Arizona Tax Credit Works. Postmark contributions or make them online by April 15th.

The state of Arizona provides an incredible incentive for taxpayers who donate to certain qualifying charities like St. Because Habitat qualifies as an eligible charity donations to Habitat are eligible for a dollar-for-dollar tax credit of up to 400 for single and 800 for joint filers. When you file your Arizona taxes you can claim a dollar-for-dollar Arizona Charitable Tax Credit that will either reduce your tax liability or increase your refund.

Marys with the Arizona Charitable Tax Credit Your charitable donation of up to 800 to St. Use Form 322 for. Individuals making cash donations made to these charities may claim these tax credits on their Arizona.

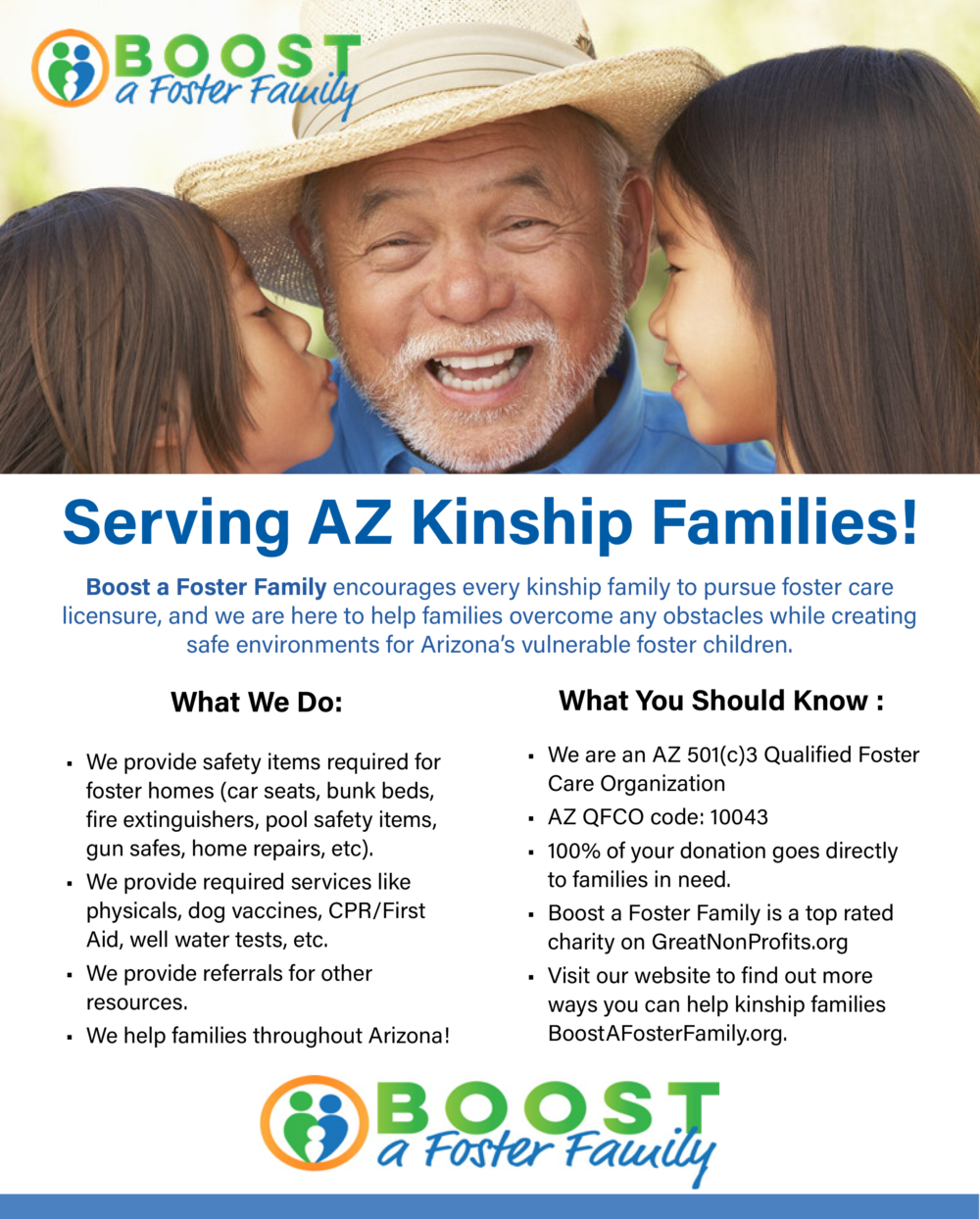

Organization But the tax break doesnt end there these donations may count as charitable contributions on your federal return as well. One for donations to Qualifying Charitable Organizations QCO and the second for donations to Qualifying Foster Care Charitable Organizations QFCO. Make a Charitable Donation to St.

If you donate to a public or private school or to a qualifying charity you claim a credit on your Arizona state income tax return. Complete Arizona tax form 321 to file with your state tax return.

How Federal And Arizona Tax Incentives Can Help You Donate To Charity

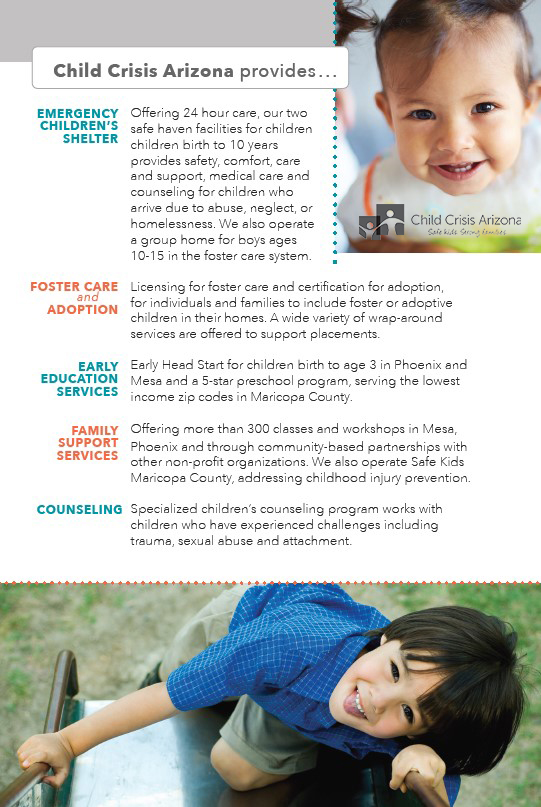

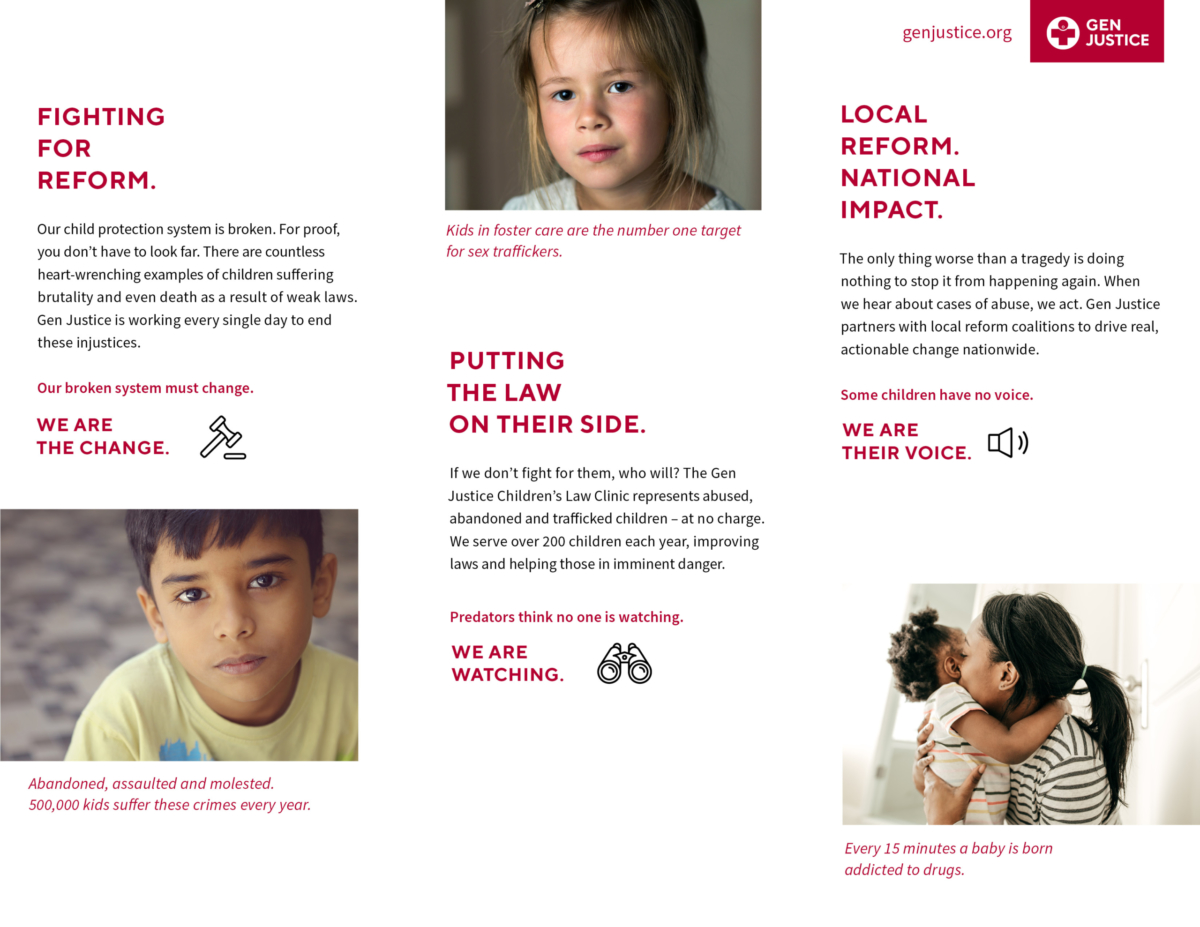

Qualified Foster Care Charitable Organization Az Tax Credit Funds

Start The Process Az Tax Credit Funds

Outdoor Patio Furniture Stores Outdoor Furniture Stores Patio Store Outdoor Patio Furniture

Qualified Foster Care Charitable Organization Az Tax Credit Funds

Home Prescott Area Tax Credit Coalition

How Federal And Arizona Tax Incentives Can Help You Donate To Charity

Qualified Foster Care Charitable Organization Az Tax Credit Funds

Phoenix Paintings Phoenix Painting Phoenix Art Artist Art

Qualified Foster Care Charitable Organization Az Tax Credit Funds

Qualified Foster Care Charitable Organization Az Tax Credit Funds

Ahwatukee Az Home Bodiac Sculpting

6 Best Printable Temporary License Plate 2014

Questions About Donating And Scholarships For Children Arizona Tax Credit

Az State Tax Credit Prescott Farmers Market

Qualified Foster Care Charitable Organization Az Tax Credit Funds